Customer churn is a significant challenge for banks, as losing customers directly impacts profitability. In this blog post, I’ll share how I used data analysis to predict customer churn and implement strategies that reduced attrition rates by 20%.

Understanding the Problem

The first step in addressing customer churn is understanding why customers are leaving. For this project, I used historical customer data, including demographic information, account activity, and customer feedback.

Data Collection and Preparation

- Data Sources: I collected data from various sources, including CRM systems, transaction logs, and customer surveys.

- Data Cleaning: I cleaned the data by removing duplicates, handling missing values, and standardizing formats.

- Feature Engineering: I created new features such as average transaction value, customer tenure, and engagement score to enhance the predictive power of the model.

Exploratory Data Analysis (EDA)

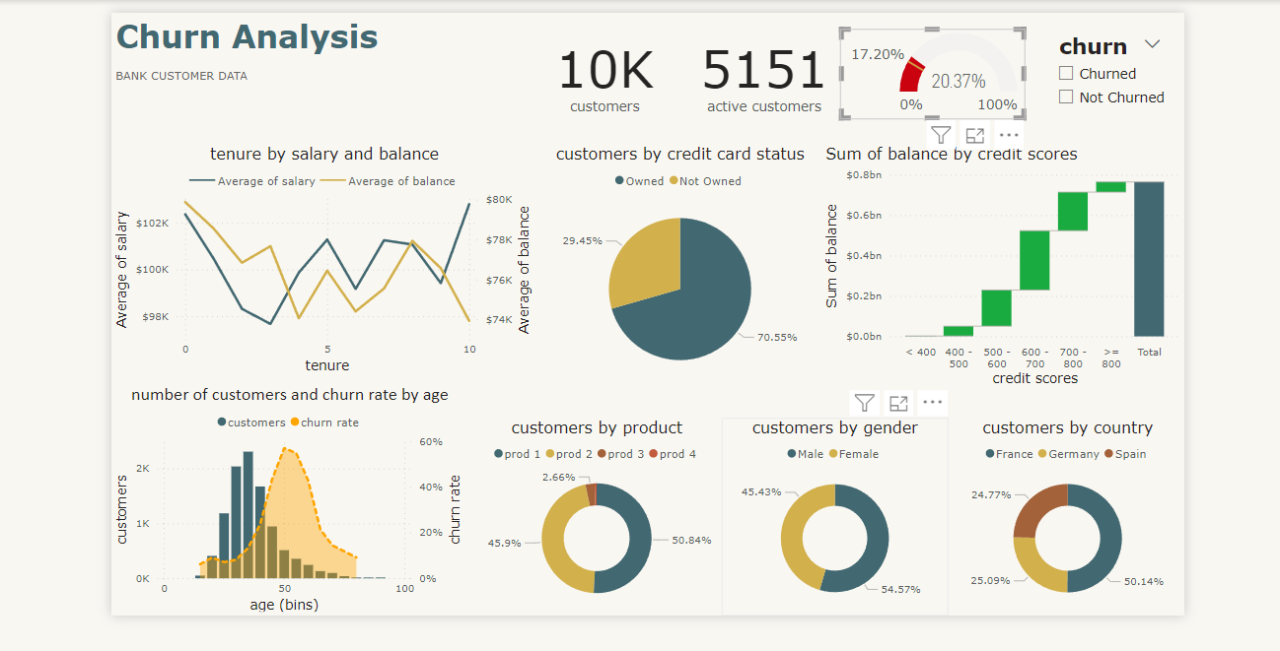

Before building a predictive model, I performed EDA to identify trends and patterns.

- Descriptive Statistics: I calculated summary statistics to understand the distribution of key variables.

- Visualization: I used histograms, bar charts, and scatter plots to visualize the data and identify correlations.

- Churn Analysis: I compared churned and non-churned customers across different features to identify significant differences.

Building the Predictive Model

To predict customer churn, I used machine learning techniques.

- Model Selection: I tested several algorithms, including logistic regression, decision trees, and random forests.

- Training and Testing: I split the data into training and testing sets to evaluate the model’s performance.

- Hyperparameter Tuning: I used grid search to optimize the model’s hyperparameters for better accuracy.

Implementing the Solution

Based on the model’s predictions, I implemented targeted strategies to reduce churn.

- Customer Segmentation: I segmented customers into high, medium, and low-risk groups based on their churn probability.

- Retention Strategies: For high-risk customers, I offered personalized retention offers such as fee waivers and loyalty rewards. For medium-risk customers, I focused on improving engagement through personalized communication and targeted marketing campaigns.

- Monitoring and Feedback: I continuously monitored the effectiveness of the retention strategies and gathered feedback to refine the approach.

Results

By implementing these data-driven strategies, we achieved a 20% reduction in customer attrition rates. The predictive model allowed us to proactively address churn and enhance customer satisfaction.

Conclusion

Data analysis can significantly impact customer retention by identifying at-risk customers and enabling targeted interventions. By following a structured approach to data collection, analysis, and implementation, businesses can reduce churn and improve profitability. If you have any questions or would like to discuss this project further, feel free to reach out!